Resales prove profitable

Resale condos in prime locations across Bangkok will remain attractive as selling prices are lower than those of new units and average capital gains remain strong, according to property consultants.

Poomipak Julmanichoti, managing director of property consultant Plus Property Co, says Bangkok’s resale condo market has grown more popular over the past four years, with selling prices 30-40% lower than those of newly-launched units in the same locations.

“The price difference between newly-launched and resale condo units is driven by higher land prices. In prime locations where land plots are scarce, the price differences are quite large,” he says.

According to the company’s research, selling prices of Bangkok Condos for Sale launched in the Thong Lor area last year started at 275,000 baht per square metre, up from 176,000 baht per sq m in 2012 — an increase of more than 56% in three years.

Meanwhile, selling prices of projects completed in 2014 have soared to 230,000 baht per sq m at present, compared with 128,000 baht per sq m on those launched in 2012 — an 80% increase in two years.

In other prime locations, including Central Lumpini, Silom-Sathon and Sukhumvit, the asking price for new high-end condo supply in the first quarter this year was 215,395 baht per sq m on average, rising 7% year-on-year, reports property consultant CBRE (Thailand) Co.

The highest price among the three locations was in Central Lumpini; up 5% to 241,700 baht. Average prices in Sukhumvit were 229,667 baht per sq m, rising 6%, and 220,000 baht in Silom-Sathon, an increase of 6%.

For resale high-end condos, prices were quoted at 200,833 baht per sq m in Central Lumpini, 194,286 baht in Silom-Sathon, and 183,810 baht in Sukhumvit — 192,976 baht on average in the first quarter — rising 5%, 4.5%, 5% and 4.8% year-on-year, respectively.

Last week, the Real Estate Information Center (REIC) reported the condo price index in Bangkok, Nonthaburi and Samut Prakarn in the second quarter this year rose 5% on average year-on-year.

The highest price increase was for units ranging between 80,001-120,000 baht per sq m, up 5.9%. Units priced higher than 120,000 baht per sq m were up 4.7% and unit priced between 50,001-80,000 baht per sq m increased by 4.2%.

Even units priced lower than 50,000 baht per sq m, which rose by 2.9%, outpaced single houses and townhouses, whose priced only increased by 1.6% and 2.3%, respectively.

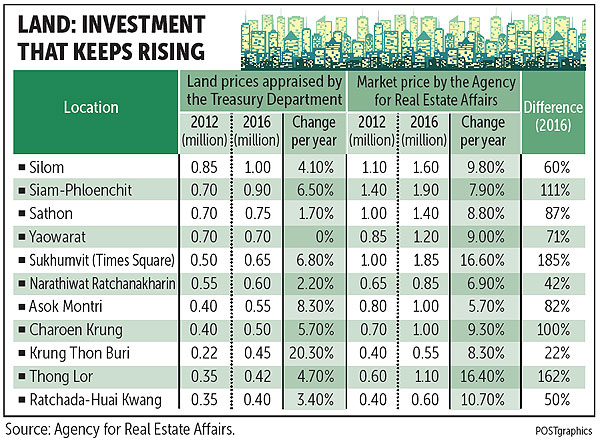

According to the property consultant Agency for Real Estate Affairs, average land prices in Greater Bangkok increased 47-fold between 1985 and 2015.

The highest increase was found in the central business district, with increases of 37.1% per year, while the metropolitan-area average was 27.4%.

Last year, the highest increases in land prices were in locations on Ratchadapisek-Tha Phra Road, Kluai Nam Thai-Rama IV and Samrong. Land prices at these locations rose more than 15% from 2014.

The highest land prices in Bangkok were in the Siam Square, Chidlom and Phloenchit areas, with appraisal prices of 1.9 million baht per sq wah or 760 million baht per rai, which is estimated to rise to 2.17 million baht per sq w next year.

It was followed by the area around the Times Square building on Sukhumvit at 1.85 million baht per sq w; Silom, 1.6 million baht; Yaowarat, 1.2 million baht; and Sukhumvit Soi 21 or the Asok area, 1.1 million baht.

Mr Poomipak says condo prices in Bangkok have continued rising on average by 7.3% and 5.2% per year during the past five and 10 years, respectively. High-rise condos in the central business district have seen the highest price increases.

“We’ve found a high-rise condo in the central business district has a capital gain of at least 50% during the first two years of ownership and 65% in the fourth year,” he said. “It can generate up to 100% if it is held for 10 years.”

He adds the resale condo market has slowed since 2014, due the economic downturn and high household debt. The company recorded 4 billion baht in sales for resale condo units last year, down from 4.7 billion baht in 2014, and aims this year to generate the same sales figures as last year.

Significantly, speculation or short-term investment, whereby resale transactions are made before the units are completed, has slowed down since last year.

“It’s now time for long-term investments as condo speculation has not been so attractive during the past few years,” he says.

“Resales during down-payment periods or when units have not been completed have dropped significantly due to the sluggish economy and property market.”

CBRE managing director Aliwassa Pathnadabutr says the Bangkok condo market in the first quarter slowed across the board, with the number of newly launched condos having been in a downward trend since the fourth quarter last year.

“In the first quarter, most large developers focused on transferring completed units and clearing built but unsold inventory to gain from the government’s stimulus measures, which ran from October last year to April this year,” she says.

For the suburban condo market, the total number of newly launched units each year has continued to fall since 2013. This reflects a slowdown in the overall Bangkok condominium market.

“As land prices are still rising, prices for newly launched condos in the best downtown locations will continue to increase. Those for suburban condo projects will slightly increase or stay flat, as there is still a large amount of supply waiting to be absorbed,” adds Mrs Aliwassa.